The world of Indian FinTech Landscape is accelerating. It offers amazing tools for wealth. Today’s professional needs clear guidance. Complex financial concepts are everywhere. This guide will demystify key topics. We aim to protect your money. We help you grow your investments smartly. This is your essential masterclass. Let’s start building a strong financial future.

Investing Basics: What are the safest ways to start investing in Indian mutual funds?

Many new investors feel confused. They want growth without high risk. Therefore, starting with Indian mutual funds is wise. They offer professional management. Mutual funds provide good diversification. The safest ways to start investing in mutual funds involve a SIP. SIP stands for Systematic Investment Plan. You invest small, fixed amounts regularly. This mitigates market volatility over time. Debt funds are best for low risk. Equity funds are for long-term growth.

Furthermore, diversify your portfolio broadly. Do not put all your money in one sector. Always check the fund manager’s track record. Review the fund house’s history carefully. Consider an ELSS fund for tax savings. This is an equity-linked savings scheme. This Beginner guide to mutual funds India is simple. It focuses on compounding.

Retirement Planning: How does the National Pension System (NPS) work for a private sector employee?

Retirement planning starts early. The National Pension System (NPS) private sector scheme is key. It offers a structured way to save. It provides significant tax benefits. For instance, your contribution is deductible. This falls under Section 80CCD(1B). This offers an extra ₹50,000 deduction. This is over the ₹1.5 lakh limit.

Furthermore, the employer’s contribution is also deductible. This falls under Section 80CCD(2). It is deductible up to 10% of salary. The final corpus is also mostly tax-free. Sixty percent of the final amount is exempt. The remaining forty percent buys an annuity. Understanding how does NPS work for a private sector employee is vital. It maximizes your tax-saving potential. This makes it a great retirement vehicle.

Global Finance: What documents are required to legally invest in US stocks from India?

Global investing is now accessible. You can buy shares in top US companies. This is done through the Liberalised Remittance Scheme (LRS). It governs all remittances abroad. This allows diversification of your portfolio. Your investments can weather market fluctuations. The LRS has a cap of $250,000 yearly.

The documents for investing abroad India are standard. You must have a valid PAN card. You need Aadhaar for KYC compliance. You also submit Form A-2. This declares the investment purpose. You must use an authorized dealer bank. Tax is collected at source (TCS) applies. This is for remittances over ₹7 lakh. Knowing the documents required to legally invest in US stocks from India is crucial. It ensures complete compliance with RBI.

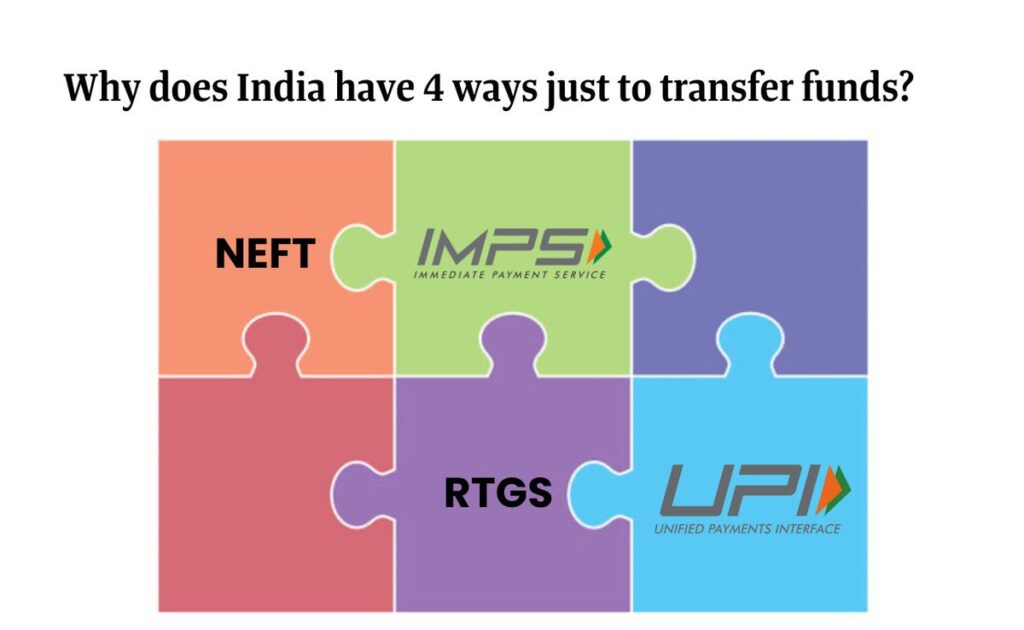

Digital Banking: How do UPI, NEFT, and RTGS differ for quick money transfers?

UPI is for instant, low-value transfers. It is mobile-based and very convenient. IMPS is also instant. It has a limit of ₹5 lakh typically. NEFT is for smaller transactions. It works in half-hourly batches. RTGS is for large transfers. It has a ₹2 lakh minimum. Both UPI NEFT RTGS difference is in speed. RTGS and UPI are real-time transfers. However, NEFT settles in batches. Knowing this helps save time.

Taxation Focus: Can I claim tax benefits on my home loan and rental property simultaneously?

This is a frequent tax question. The answer is yes, you can. You can claim tax benefits home loan rental income. This is possible if they are separate properties. You can claim interest on your loan. This is deductible under Section 24(b). This applies to your let-out property. There is no upper limit on this interest.

Furthermore, you can claim HRA exemption. This is for the rent you pay. The property you own should be rented out. The loss from your property is capped. The overall loss offset is limited. You must not occupy your own house. You must prove genuine tenancy. Thus, you can claim both deductions. This depends on your usage perfectly.

Risk Management: What are the biggest financial scams targeting Indian mobile users today?

Digital convenience creates new risks. Financial scams targeting Indian mobile users are on the rise. Fraudsters use very deceptive tactics. Phishing is among the most common. Victims receive fake links or emails. They are asked for their UPI PIN. Types of UPI fraud in India are diverse.

Another major threat is remote access fraud. Scammers ask you to download apps. They gain control of your phone. They then access your UPI details. Also, watch out for fake QR codes. These look like legitimate payment requests. Never enter your UPI PIN to receive money. Always be vigilant online. This is the first line of defense. The number of Financial scams India 2025 is high.

FAQs: Protecting Your Digital Wealth

Q1: What is the maximum deduction I can claim under Section 80CCD(1B)?

A1: You can claim an additional ₹50,000. This is over the Section 80C limit.

Q2: Is it safe to share my UPI ID?

A2: Yes, your UPI ID is safe to share. Never share your UPI PIN or OTP.

Q3: What is the benefit of using SIP for mutual funds?

A3: It minimizes market volatility. It instills saving discipline. It helps you buy more units.

Q4: Which is faster, NEFT or RTGS?

Q4: RTGS is faster. It settles transactions instantly. NEFT works in batches.

Q5: What is the LRS limit for investing in US stocks?

A5: The limit is USD 250,000. This is per financial year.

Your Financial Mastery Begins Now

You have the knowledge now. You can navigate the Indian FinTech Landscape well. You can make smart investment choices. You can avoid common pitfalls. This is the time to secure your future.

What is the first step you will take this week to secure your digital finances? Will you finally start your National Pension System (NPS) private sector contribution? Share your plan below!

#FinTechIndia #IndianFinance #NPSforPrivateSector #InvestInUSStocks #MutualFundsIndia #UPIFraudAwareness #TaxSavingTips #DigitalBanking #PersonalFinanceIndia #DigitalRupee

![Relationship Goals Review: Is It Your Next Favorite Rom-Com? [2026]](https://outfluent.blog/wp-content/uploads/2026/02/Relationship-Goals-Review-1-180x135.jpg)

![Cradle of Kindness: A Mumbai Cop’s Heartwarming Gift| Viral Stories [2026] Cradle of kindness](https://outfluent.blog/wp-content/uploads/2026/02/Mumbai-cop-kindness-180x135.webp)

The Digital Money Masterclass: Decoding India’s FinTech Landscape | Outfluent

[url=http://www.g5g07pyo8m89c2bc40qc7oi1qw0r0750s.org/]uofjvpizqzv[/url]

aofjvpizqzv

ofjvpizqzv http://www.g5g07pyo8m89c2bc40qc7oi1qw0r0750s.org/

贝博足彩

赌厅网投

贝博足彩

http://www.faarte.com.br

赌厅网投

贝博足彩

在线赌场游戏

在线赌场游戏

赌厅网投

澳门博狗

arek.ewitar.com.pl

贝博足彩

澳门博狗

贝博足彩

贝博足彩

贝博足彩

techbase.co.kr

澳门博狗