Blockchain evolution

Overwhelming majority of transactions have been digitized since the advent of internet and that vast majority of those transactions require a centralized intermediary. But even with such a preponderance of digital transactions, we still find 62 % or 2.5 billion of the world’s adult population is unbanked (source :World Bank Index measuring financial inclusion around the world) and we find transaction costs in some cases, as high as 20%. These circumstances gave birth to the necessity for an invention like blockchain. But blockchain was not alone in trying to alleviate these problems. There were contenders such as distributed databases, key-value stores (like AWS S3) which could have scaled to requirements. Blockchain survived this test of evolution by enabling decentralized, cryptographically secured currency, which enabled two mutually distrustful parties to transact. In the event of a breach of contract, the nature of blockchain – which exposes in the clear, parties involved in transaction & the amount and enables the network to obtain commensurate remuneration to the honest party.

In the traditional financial systems, enabler of the transaction is the central authority/ intermediary and custodian of the ledger, which stores all the transactions. Fierce competition between few intermediaries to gain trust of individuals, results in creation of monopolistic organizations. Such organizations are moral hazard for the entire financial ecosystem, as they are “too big to fail” and this led to the financial crisis in 2008.

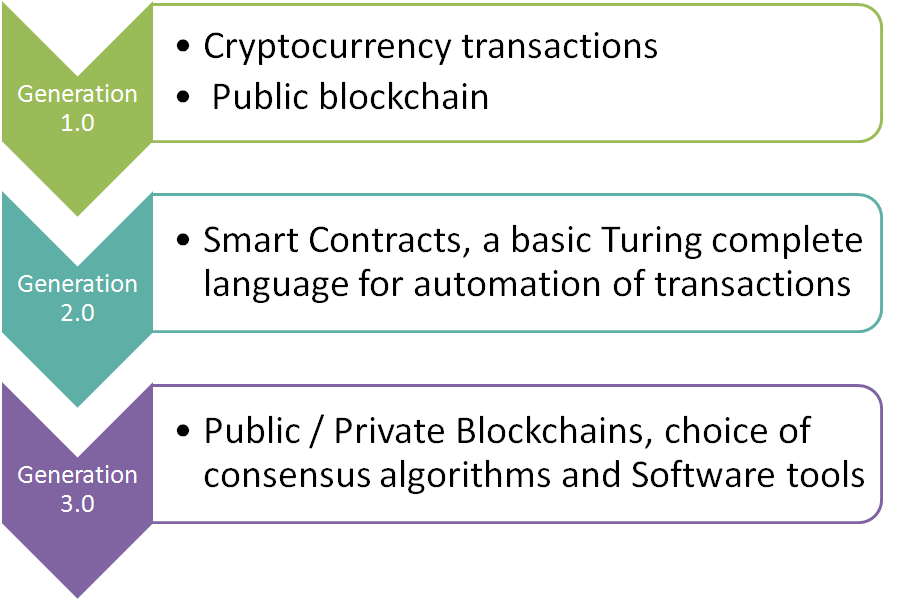

On the hindsight, when we look at the evolution of blockchain, launch of Bitcoin Cryptocurrency & blockchain source code, in 2009, was genesis event in the evolution of blockchain. This was disruptive technology for traditional transactional systems explained above. It offered cryptography and immutability for transaction security and decentralized control of transaction approval to dismantle monopolistic system of intermediaries. This was perceived as a threat of ceasing to exist for those intermediaries and contending computing systems. Evolution of Blockchain happened on the principles of biological evolution. Biological evolution is change in heritable characteristics of biological populations, over successive generations. Similarly, every new generation of blockchain had heritable characteristics e.g. cryptography & immutability and changes happened in characteristics of consensus algorithm, nature of blockchain (only public to public –private). Evolutionary processes give rise to biodiversity and decedents replace members of population and are better adapted to survive, as natural selection takes place. To draw parallels, in every next generation of blockchain, there was a diversity, in terms of characteristics, adaptability to the demands of ecosystem and they survived the tests conducted by stakeholders of the ecosystem (Developers, intermediaries & user organizations).

However, introduction of Smart Contracts in blockchain was trailblazing event, which has changed the dynamics of transactional computing, something similar to a strike of meteorite, which changed the dynamics of biological ecosystem. Blockchain has evolved to be a “Potential Future Computing Backbone Infrastructure”

This potential to be a computing backbone infrastructure, has opened plethora of opportunities for businesses and developers, to help blockchain evolve into its next generation, which will happen around:

- Interoperability between blockchains

- Speed to match future demand of transactions

- Scalability for enterprise applications

- Distributed platforms to build blockchains & supporting interfaces to facilitate all types of transactions, without any intermediary, with extremely low cost of operations.

- Platforms offering application interfacing to bridge disconnect between legacy computing systems & blockchain

Blockchain Use Cases

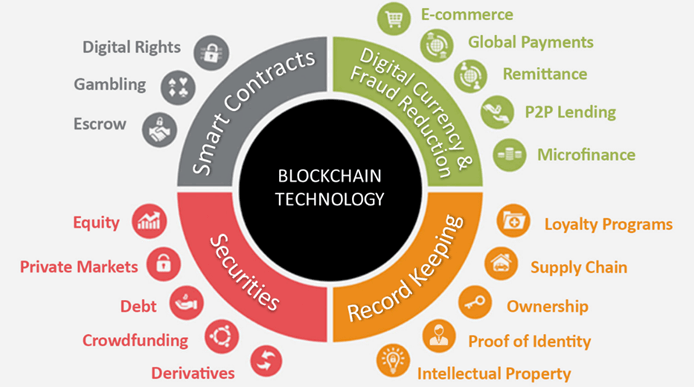

Blockchain computing architecture is in public domain for almost a decade now. It has always been co-related to Cryptocurrencies, e.g. Bitcoin, Ether, etc. For a new technology to realize its full potential, lot of pieces need to exist before network effects can be realized. The blockchain community is indeed witnessing unprecedented levels of industry collaboration between players who are otherwise competitors. Apart from that, open source technologies are typically adopted by limited techo-savvy people/ organizations first, but over the period as the successful use cases crosses critical mass, adoption of technology increase exponentially. We are not there yet! However, it will be interesting to see current use cases.

Till 2009, only currencies world had seen were, sovereign fiat currencies. Nobody had even dreamt of a digital currency, floating in virtual world. But, Bitcoin became first such digital Cryptocurrency, minted in cyber world. With that floodgates opened for many more Cryptocurrencies getting floated at drop of a hat. These are native currencies, of those respective blockchains. Cryptocurrencies are traded world over, on some of the busiest exchanges, without any reported security breach of currency itself. Ethereum claims that it can support fiat currencies with asset backing too. Venezuela is working on oil backed crypto currency on blockchain technology, even Russia has similar plans.

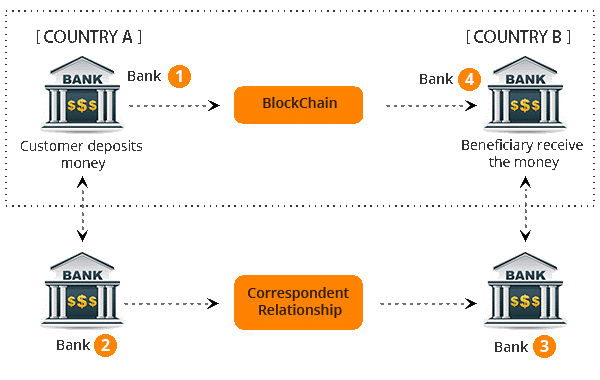

Traditionally, payment transfers between two entities is routed through multiple intermediaries e.g. central bank and banks at both ends, this network of intermediaries validates credentials of both sender & receivers and then effect payment transfer. These intermediaries charge fees for the same. However, Bitcoin can be used for online payment transfers between two entities, without need of intermediary. Users can create online wallets and Bitcoins can be transferred from one such wallet to other, instantly, in most secured manner with blockchain technology, with very low transaction cost. This technology can be best used for cross border remittances. As originally envisioned by Satoshi Nakamoto, blockchain can form backbone of any financial infrastructure, irrespective of stream of operations, in the financial world. Technically, it has capabilities to blow off the whole bunch of financial intermediaries, from banks to brokers to exchanges and what have you. However, in the interest of financial markets, blockchain is best adopted by financial intermediaries and reduction of cost, better transparency is passed on to the consumers & public at large.

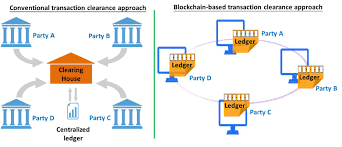

Financial markets typically have 3 day clearing & settlement cycles, e.g. D+3, T+3, etc. These are common to most investment markets today. This is due to time taken for processing humongous quantity of transactional records, through intermediaries such as custodial services (CSDs), central counterparty clearing systems (CCPs) and complex collateral management systems, together it costs billions in overhead. Migrating these transactions on blockchain will reduce the duty cycle of their clearing and settlement processes, where all counterparty balances are matched, reconciled and resolved across global trading system. This will positively impact large no of investors, day traders, pensions funds, market makers, asset managers. This is by far one of the most rewarding use cases of blockchain in financial markets, because in short time span there is visible cost savings. According to Santander’s 2015 report, moving into digital records, near real-time & over the internet, will save the industry $20 billion a year or more.

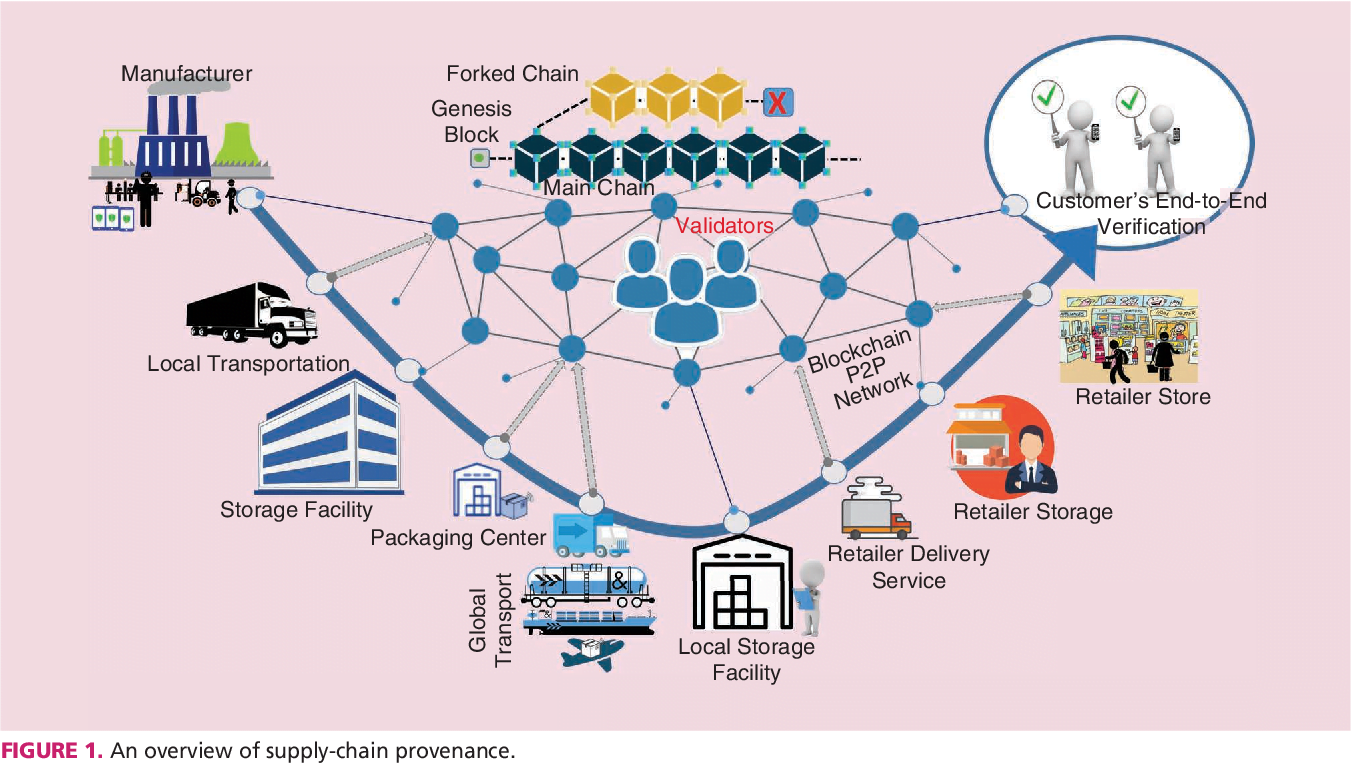

In supply chain management, ethical source, compliances, record of transactions and processes are critical. However, due to grey areas such as questionable sourcing, aging of raw material, wrong routing of materials, etc. the chain produces negative results, impacting entire business value chain. Therefore, it is totally about the trust among intermediaries and intermediate processes. However, with deployment of blockchain in supply chain management its dynamics have changed. The need for trust is eliminated because of the system, consisting of immutable record of transactions with time stamp associated with every asset/product in the chain. The products bought and sold in various supply chains of the world, are getting recorded in near real-time on a shared ledger, at every stage. Real time bills of landing & letters of credit are recorded & documented against asset movements. Products & their values, tax and any other statutory compliances are available on screen. Using block chain an irreversible & immutable trail of transactions is established in the supply chain management, which is reflected in transparency of process, e.g. Fish caught by fishermen are tagged by IoT enabled sensors and tracked all through the supply chain, from place to place and recorded on blockchain. That offers transparency and result in rewarding ethical fishermen.

Currently, it is difficult in tracking movement of products across value chain, which give rise to production delays, delayed project execution and such similar scenarios. Inputs of blockchain based supply chain management system can be part of Smart Asset Management. Through a tag such as RFID, product turns into a smart assets, which is easily tracked in the value chain. Every asset turns smart, when all the details about the asset, including serial numbers, value and any other information we need to know about that asset. They are digitized right from manufacturing stage till end of life cycle, e.g. who is it coming from and where is it going to; how it relates to other assets, etc. This is a great competitive tool for market players to win clients with richness in data availability.

Normally, when a car exchanges hand, the transaction is based on the trust buyer has, in what seller says about the car, apart from what meets the eye. There are situations where seller cheats. This is where blockchain deployment for Provenance comes in picture. Where blockchain of a car has records, right from manufacturing stage to all services/ repairs it underwent, which will again offer transparency. It can be similarly deployed in apparel industry, where tracking from cotton to T-shirt, is recorded on tamperproof blockchain. It can deployed for manufacturing of canned foods/juices, wherein a QR code on can of juice can offer, details about various stages of juice making and for that matter every manufactured product. Using blockchain one can track product, through its life cycle. It can offer trail about exchange of ownerships, repairs/ damages and any such important aspect of a product.

There are instances of data thefts, every now and then. Confidential records, financial data, personal details are vulnerable in current setup. Blockchain was conceived on the foundation of trust for trustless environment. It was open and transparent to an extent any anonymous entity can be part of blockchain, with malicious intentions. However, in private Permissioned networks, vulnerability of data diminishes with privacy by design principle incorporated in some iterations of blockchain. This opens a use case of Digital Identities which are recorded on blockchain protocol, then my things can have authorization to transact on my behalf. In other words, I have an identity recorded on a shared ledger, and then can add devices to my identity. Over time, I add smart objects too, from my shoes to my fridge to my car to my heating to my spectacles to my anything.

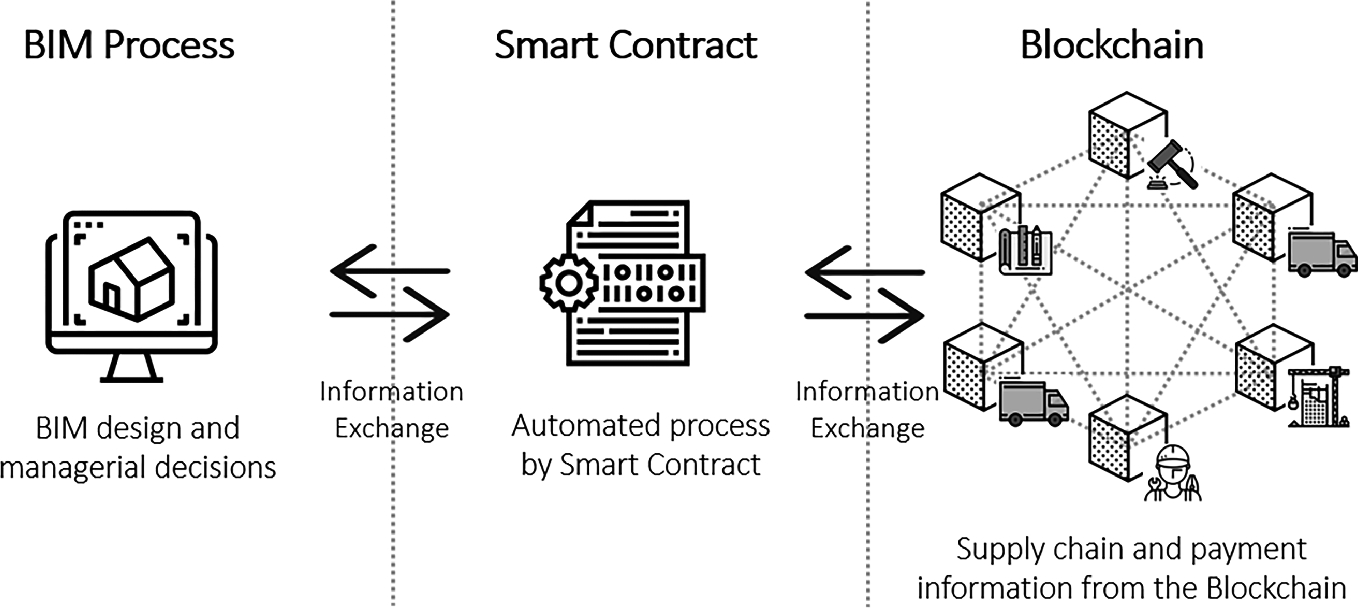

Currently, in legal structure there are just too many papers. Solicitor firms, lawyers keep voluminous records of contracts/ agreements between the parties. They are custodians of the trust in financial, social and political ecosystems. Control of every legal aspect is vested with these people. This at times is reason for failure of many agreements, contracts and rise in disputes. Smart Contracts of blockchain ecosystem is game changer for the legal industry. Legal contracts can be embedded in transactional computing, using control mechanisms. Wherein, legal agreements would be executed automatically, upon hitting the trigger condition.. If all the legal agreements/ contracts are digitized, those contractual instruments, would be self executing programs. In true sense, blockchain is something which tell you what happened and how it happened, leaving a irrefutable digital trail, that this thing happened at that time on this date between these counterparties. This could be anything from a marriage vow to a divorce proceeding; a house sale to a land reclamation, etc.

There is a lack of transparency in land and real estate transactions. Inefficiencies get added with no. of intermediaries operating in that sector. Apart from that real estate transactions involve numerous parties and transactions continue to be paper-based. Overall sector is vulnerable to disputes, defaults, frauds, etc. If blockchain is adopted in construction sector, It can help the sector in multiple ways, first it can create blockchain of land records, housing records, taxes and statutory obligations pertaining to construction sector. Once this underlying layer of data in place, government departments, builders, aggregators in real estate, buyers & sellers would have a transparent records about every detail pertaining to any property or land. Online aggregators can list properties, which will allow sellers, buyers & their realtor representatives to see all offers and transactions at the same time in real time. Smart contracts can facilitate automatic execution of transactions, once parties have agreed on its conditions, also solve the confirmation and verification process.

There are few other use cases under consideration, e.g. for data security during its exchange between disparate cloud services, blockchain based forecasting for shares & commodities, decentralized micro-blogging, etc. In times to come market would be flooded with use cases for newer areas.

There are challenges for DLTs to reach critical mass, e.g. lack of standards, regulatory challenges and the lack of knowledge & non availability of experts in the area of DLTs. These challenges are inherent to any new technological infrastructure that replaces an older infrastructure. As an infrastructure technology, all major stakeholders such as academicians, research institutions, market players, developer community need to work together in defining standards in a democratic manner. Indeed, there is a development with establishment of standards framework ISO / TC 307, though early days.

![Daldal Review: A Scary Look into Mumbai’s Dark Secrets [2026] Daldal review](https://outfluent.blog/wp-content/uploads/2026/01/Daldal-Review2-180x135.webp)

![Daldal Review: A Scary Look into Mumbai’s Dark Secrets [2026] Daldal review](https://outfluent.blog/wp-content/uploads/2026/01/Daldal-Review2-100x75.webp)

Blockchain Evolution & Use Cases | Outfluent

[url=http://www.g7k1rnl53mq18el254t9mv9225jn95ggs.org/]ugsjtonexe[/url]

gsjtonexe http://www.g7k1rnl53mq18el254t9mv9225jn95ggs.org/

agsjtonexe