Hey crypto enthusiasts! The cryptocurrency market today is certainly a wild ride. It feels like every day brings new headlines, right? Many investors still feel a bit uncertain. Yet, believe me, massive opportunities remain for those who understand the game. The Bitcoin price trends have truly dominated discussions YTD. The market has shown incredible resilience, much to everyone’s surprise. We’re also seeing new narratives emerge that could shape the next bull run. This expert guide breaks down everything for you simply. We will analyze the shining stars and the unfortunate fallen. Most importantly, we’ll help you refine your crypto investment strategy

YTD: A Rollercoaster Ride with Surprises

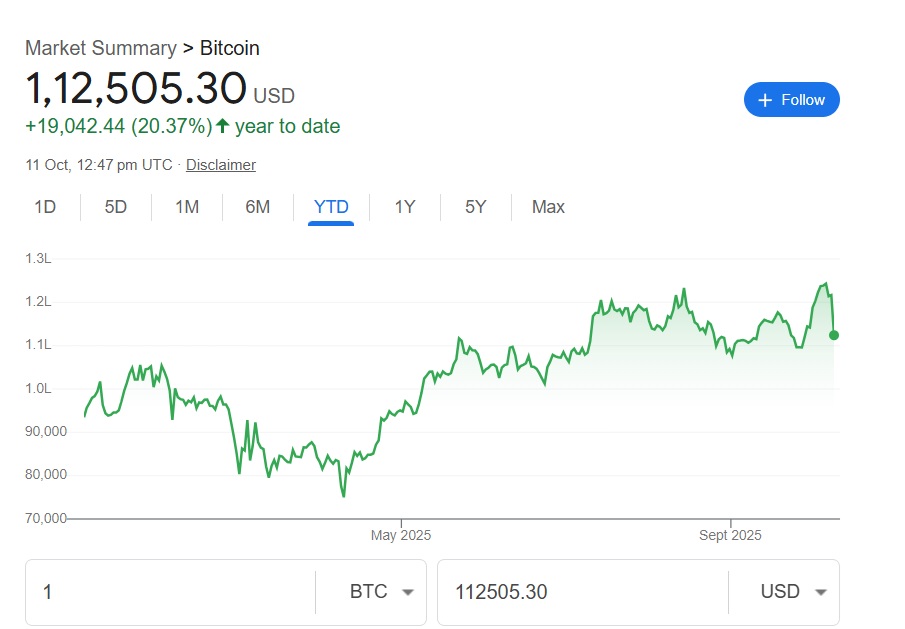

The year started with some caution. Inflation fears were quite high globally. Global economic pressures also persisted for a while. However, Bitcoin price trends truly defied expectations. Bitcoin saw a strong recovery early on. For example, it jumped from around $92,000 in January to over $1,20,000 earlier this week. This surge built market confidence quickly. Many analysts even predicted this rebound early. The overall cryptocurrency market today definitely reflects this positive vibe.

But, it wasn’t smooth sailing always. We witnessed periods of volatility too. Short-term corrections were quite common, as usual. For instance, Bitcoin might drop 10-15% in a week, then recover,e.g. On 7th Oct. it was $,1,24,000 and over this weekend it’s now $1,12,000. Nevertheless, the underlying trend mostly stayed positive. Institutional interest grew steadily this year. This propelled the market forward significantly. This year’s Bitcoin price trends are a clear testament. They show crypto’s growing maturity.

The Shining Stars

Several cryptocurrencies truly shone brightly. They delivered impressive returns for smart investors. These specific projects are really driving innovation. They are actively building the future of Web3 innovation.

Ethereum Ecosystem: The Unstoppable Powerhouse

The Ethereum ecosystem continues its strong dominance. It remains the backbone of decentralized finance (DeFi). The successful Dencun upgrade was a huge win. This significantly reduced transaction fees on Ethereum Layer-2s, sometimes by over 90%. This boosted network efficiency greatly. This strengthens the Ethereum ecosystem further. Many Layer-2 solutions truly thrived. Projects like Arbitrum and Optimism saw massive user growth. For instance, Arbitrum’s Total Value Locked (TVL) increased by over 30% YTD. This shows the platform’s vital role. It is a true leader in blockchain technology.

Solana Comeback: Resurgence and Resilience

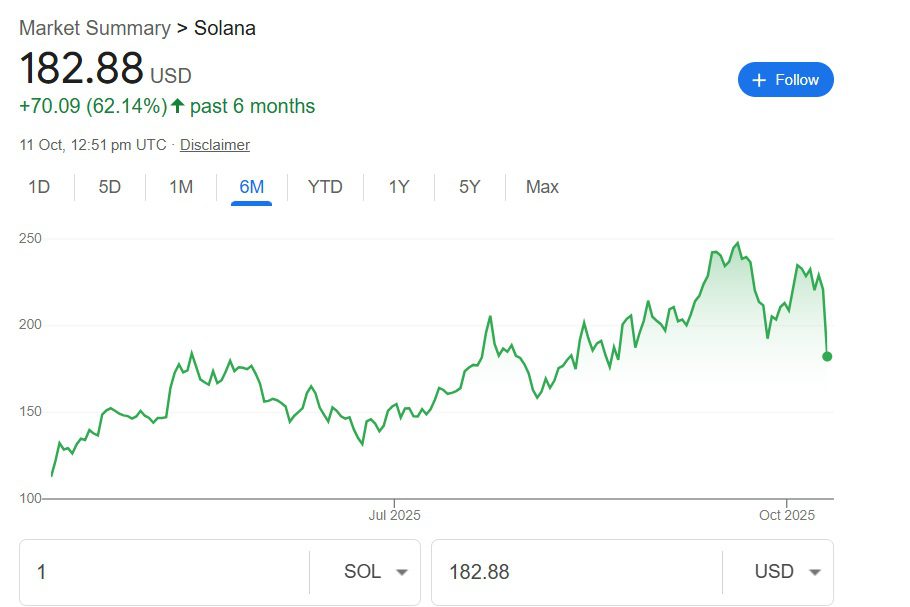

The Solana comeback has been truly remarkable this year. After earlier challenges, it bounced back strongly. Its high transaction speeds are very appealing. Solana can handle thousands of transactions per second. This attracted significant developer activity. New projects launched on Solana, including many popular meme coins. This boosted its market cap greatly. The Solana comeback solidified its position. It proved its underlying technical strength. Investors are watching this closely.

Emerging Altcoins, and Niche Players

It feels like we’re finally in an altcoin season, right? This means smaller cryptocurrencies are doing really well. Several tokens, not just Bitcoin or Ethereum, truly outperformed the main market. These unexpected stars delivered amazing results.

Also, “Real World Asset (RWA)” tokens are growing incredibly fast. Imagine bringing something like real estate or even gold onto the blockchain. A token called “LandBlock” might let you own a small part of a property through crypto. This shows great diversification in the market. It means crypto is connecting with our daily lives.

This ongoing altcoin season truly offers huge gains. However, remember, thorough research is always essential. Just like picking a good stock, you need to understand these projects. This applies to every good crypto investment strategy. Don’t just follow the hype!

US Government Initiatives: A New Tailwind?

The US government’s stance is often crucial. Their decisions directly impact Bitcoin price trends and the entire market. Recently, we’ve seen some positive shifts. For instance, the Bitcoin ETF approval was a game-changer earlier this year. The SEC (Securities and Exchange Commission) finally approved spot Bitcoin ETFs. This opened the door for huge institutional money. Billions of dollars have already flowed into these ETFs. This is a massive win for institutional crypto adoption. It validates Bitcoin as an asset class.

Crypto, Welcome Home. pic.twitter.com/7HPsp0vhcZ

— Treasury Secretary Scott Bessent (@SecScottBessent) July 30, 2025

Also, discussions around clearer crypto regulation are ongoing. While slow, the move towards a clearer framework is positive. This helps foster a safer environment. It reduces uncertainty for big players. So, these US government crypto initiatives, especially the Bitcoin ETF approval, are definitely helping the markets mature and grow. They are attracting new capital.

Expected Trend Till Year-End: What Lies Ahead?

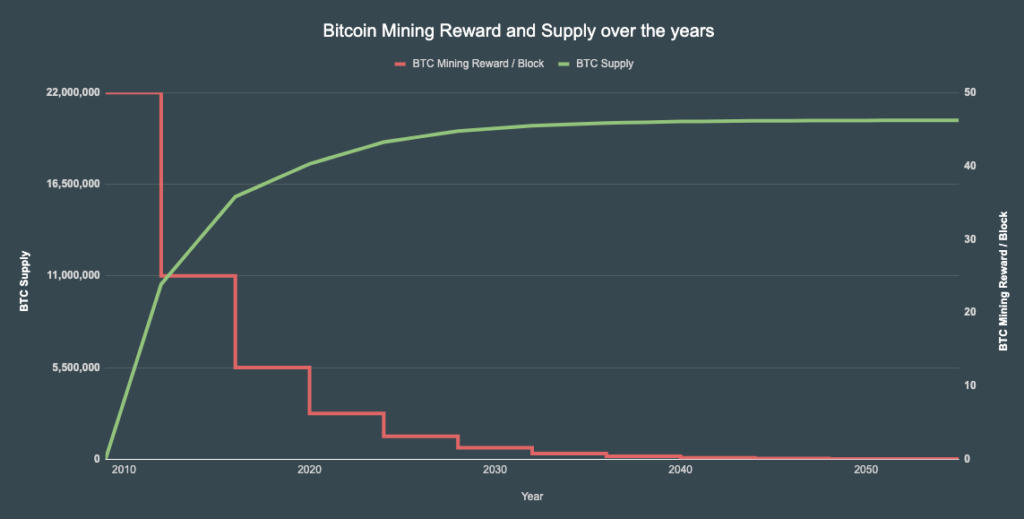

The market sentiment remains cautiously optimistic. Several factors will shape the trend. The Bitcoin halving in 2028 is a major event. It reduces new Bitcoin supply, cutting it in half. Historically, this often fuels bull runs in the following months. However, its exact immediate impact is always uncertain.

Furthermore, institutional crypto adoption is rising. Big financial players are actively entering the space. They offer new investment products like spot ETFs. This brings more capital to the market. For example, a recent report showed institutional inflows exceeded $1 billion last quarter. This lends huge legitimacy to crypto. DeFi growth will also continue its strong pace. New innovations are constantly coming in decentralized finance. However, crypto regulation is also a key factor. Clear rules build trust for investors. Unclear rules create uncertainty. Geopolitical events also influence prices sometimes.

We expect continued volatility, for sure. However, the overall trend is likely upward. This is driven by utility and adoption. This is a critical time for the cryptocurrency market today. This is important for Web3 innovation.

What Should Crypto Investors Do?

This volatile market needs smart moves. Your crypto investment strategy must be robust.

Diversification is Key

Never put all your eggs in one basket. Diversify across different assets. Consider established players like Bitcoin and Ethereum. Also, explore promising altcoins carefully. This balances risk with reward.

Research Thoroughly

Always do your own research (DYOR). Understand the project’s fundamentals. Look at its use case and team. Avoid hype-driven decisions. This protects your portfolio greatly.

Long-Term Perspective

Cryptocurrency is not a get-rich-quick scheme. Adopt a long-term mindset always. Focus on projects with real utility. Ignore short-term price fluctuations. The Bitcoin halving is a long-term driver, not a pump-and-dump.

Stay Updated on Regulation

Crypto regulation is evolving rapidly. Keep informed about new laws. These can impact market sentiment directly. Compliance is crucial for long-term health. Follow developments in US government crypto policy closely.

Risk Management

Only invest what you can afford to lose. Set stop-loss orders. Avoid emotional decisions. This protects your capital effectively. Meme coin volatility requires extra caution.

FAQs: Your Crypto Questions Answered

Q1: What is the significance of the Bitcoin halving?

A1: It reduces the reward for mining new blocks. This cuts new Bitcoin supply. Historically, it precedes bull markets.

Q2: What is institutional crypto adoption?

A2: It refers to large financial institutions. They invest in or offer crypto products. This includes banks and asset managers.

Q3: Is DeFi growth slowing down?

A3: No, it is not. DeFi growth continues to innovate. New protocols and applications are emerging constantly.

Q4: What should I know about meme coin volatility?

A4: Meme coins are highly volatile. They are driven by social media hype. Invest very cautiously in them.

Q5: How important is crypto regulation for the market’s future?

A5: It is extremely important. Clear regulations can foster trust. They attract more institutional capital. The US government crypto moves are crucial.

Q6: What was the impact of Bitcoin ETF approval?

A6: It allowed traditional investors to access Bitcoin easily. This brought billions in new capital. It significantly boosted institutional crypto adoption.

The Digital Frontier Awaits

The cryptocurrency market today is complex. It is full of promise and peril. Your crypto investment strategy is crucial. Adapt, learn, and stay informed. The next phase of Web3 innovation is coming.

What is your boldest prediction for the Ethereum ecosystem by year-end? Which new altcoin do you believe will surprise everyone, perhaps with a huge Solana comeback type surge? Share your insights below!

#CryptoMarket #Bitcoin #Ethereum #Solana #Altcoins #CryptoInvesting #DeFi #Web3 #Blockchain #CryptoNews #InvestmentStrategy #Crypto2025 #HalvingImpact #USEconomy #SECCrypto

![Daldal Review: A Scary Look into Mumbai’s Dark Secrets [2026] Daldal review](https://outfluent.blog/wp-content/uploads/2026/01/Daldal-Review2-180x135.webp)

![Daldal Review: A Scary Look into Mumbai’s Dark Secrets [2026] Daldal review](https://outfluent.blog/wp-content/uploads/2026/01/Daldal-Review2-100x75.webp)