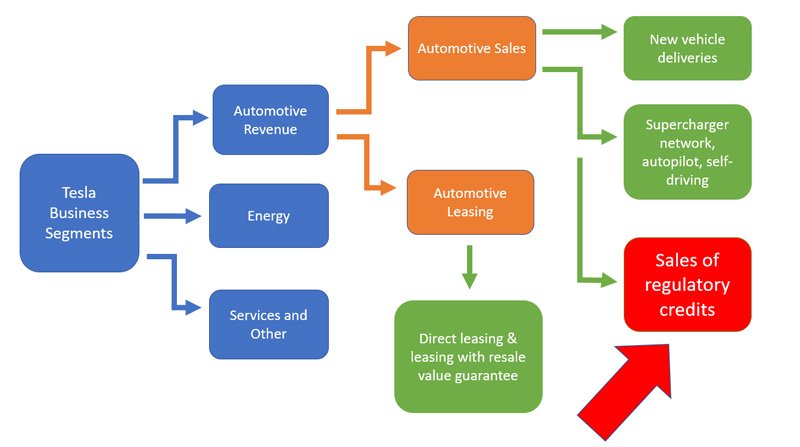

Tesla had to earn US$ 401 Million of regulatory credits in Q4 of FY20, for net income of US$ 270 Million. Best part about regulatory credits is that, they get directly added to the bottom-line. Tesla has secured almost US$ 1.6 Billion in these credits, till now.

Why regulatory credits to Tesla ?

Many governments across world incentivise auto manufacturers, to produce low emission vehicles, e.g. in Europe, vehicles emitting more than 95 Gms of CO2 per KM, are fined for and that emitting less than 50 Gms. of CO2 are incentivised with “Super Credits”.

China and 13 states, including California (Where Tesla has a manufacturing facility), in USA have such credits for auto manufacturers. There are rules related to minimum nos of vehicles required to be manufactured under this category, viz a viz total sales in the particular state. The incentives increase depending upon the range of vehicle.

All the auto manufacturers are required to earn a minimum no. of regulatory credits. In case they don’t earn internally, they can purchase from other manufacturers, like Tesla.

Tesla manufactures only electric cars, which are Zero Emission Vehicles (ZEV). That means they get regulatory credit for each car they manufacture. They keep getting regulatory credits, over and above the stipulated ones. The excess credits, thus accrued, can be sold to other auto manufacturers for profit. The profits, thus generated mostly goes to bottom-line of Tesla.

Tesla market run

Over the years, markets always witnessed that Tesla over-projects and under-delivers. Most times, they have missed their new model rollout plans, quarterly nos., etc. Tesla is also surrounded by lot of lawsuits and controversies. Thanks to CEO Elon Musk. The stock under performed over these years.

However, last year, during Covid-19 lockdown period, it caught fancy of market. It rose more than 700%. This was termed as “Renewable Energy / Electric Vehicle play”. In Indian markets also companies like Tata Motors & Mahindra had a stellar run, as a rub-off effect of Tesla rally. In fact, most months, they rallied in tandem.

Tesla business model

All these regulatory credits have formed part of Tesla’s net income, over last few quarters. Hence, in spite of making operational losses, it is able to generate net income only on the basis of these credits. To that extent, it has excess dependence on this credits.

However, the market for this is not structural and in fact uncertain. During Q4-2020 earnings call, in a reply to query, related to the outlook of these credits, Tesla CFO categorically said “What I’ve said before is that in the long-term, regulatory credit sales will not be a material part of the business and we don’t plan the business around that,” he said at that time. “It’s possible that for a handful of additional quarters it remains strong. It’s also possible that it’s not.”

Sustainability of regulatory credits ?

Ace fund manager Michael Burry, who was the first to identify Sub-prime mortgage crisis, and made fortune out of it, has made a bearish bet of almost half a Billion in puts of Tesla. He is skeptical about these regulatory credits and Tesla’s over dependence on that.

Most of the auto manufacturers, including a recent one- Lamborghini, have realized need of the hour. They are moving to either electric or hybrid models. Hence, in future most manufacturers will get regulatory credits and there won’t be many takers of Tesla’s regulatory credits. This rightly poses risk to future revenues of Tesla.

Nobody knows, what’s lying ahead for the fortune of Tesla. But, those who invested in Tesla, during lows of March-2020, are sitting on huge profits.